While the Hills Are Still Alive

First published in the Huffington Post, May 16, 2013

Sorry if I put this ear-tickling Rogers and Hammerstein song into your head today, but as you’re now stuck singing it all day, you might as well listen to the lyrics. The alpine mountains that go so well with the song’s swelling orchestrations are in retreat. In Glacier National Park in the United States, there were 150 glaciers at the turn of the 20th century. Now, there are only 26, and those are shrinking rapidly. The same is happening for Maria von Trapp’s beloved Austrian Alps. This was almost unimaginable a generation ago and would have sounded preposterous in 1959. Now, when we can well imagine, no — witness, the impacts of climate change, we still act as though our actions have no impact.

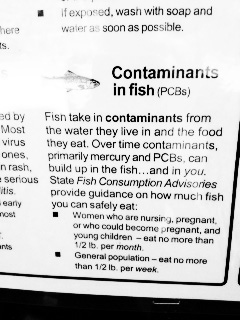

I spent a beautiful day in the Delaware Water Gap area last week. It’s amazing how close this breathtaking region is to NYC. But when I saw the sign above about polluted fish my delight was truly deflated. This park and sanctuary does not protect the nature within its boundaries. No national park classification prevents pollution from spoiling its air, land and sea.

You can’t eat the fish in an area famous for great fishing spots and if this fish is not good for us to eat, imagine the experience for the fish themselves, as well as the effects this contamination has on the rest of the critters that need the fish for their diets, and the rest of the ecosystem of which the fish is a central part. In 1959, when The Sound of Music hit Broadway and three years before Rachel Carson published Silent Spring, it

You can’t eat the fish in an area famous for great fishing spots and if this fish is not good for us to eat, imagine the experience for the fish themselves, as well as the effects this contamination has on the rest of the critters that need the fish for their diets, and the rest of the ecosystem of which the fish is a central part. In 1959, when The Sound of Music hit Broadway and three years before Rachel Carson published Silent Spring, it

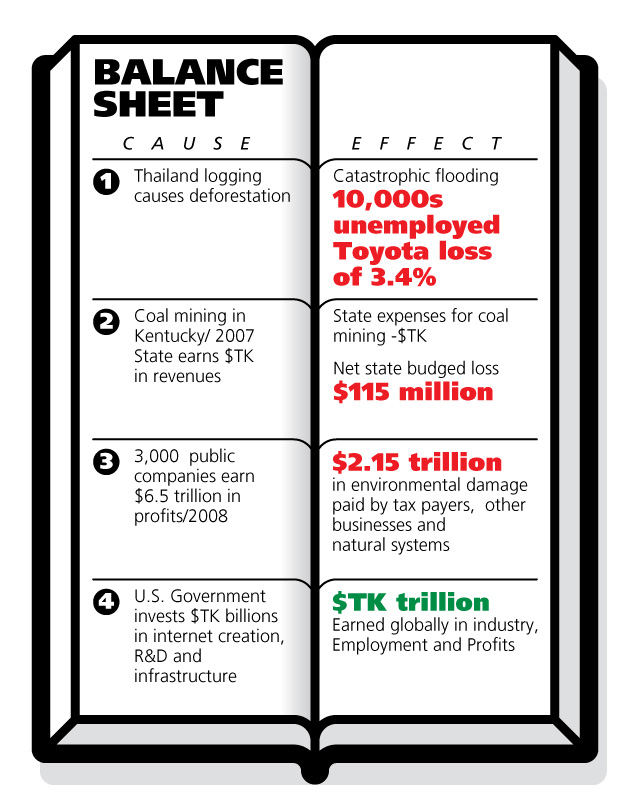

deficit), these costs were not mentioned during the recent U.S. Congressional debate about the sequester. This “environmental debt” has not yet entered our governments’ financial deliberations.

deficit), these costs were not mentioned during the recent U.S. Congressional debate about the sequester. This “environmental debt” has not yet entered our governments’ financial deliberations.